Online shopping in the UK is growing. Recent predictions show that the UK’s online spending will increase by 30% by 2024. This is why the payment process is the most essential part of selling products and services online. Online stores must get this right or risk losing customers. In today’s online retail world, two-thirds of online shopping carts are abandoned, and a poor checkout experience is one of the main reasons why. Optimising your checkout page can help customers make their purchases and boost your sales without friction or hassle. Here are a few ways your payment process can be streamlined in your website design:

Finding the right payment service provider

When buying from your business, different customers will want to pay in different ways. Investing in a good payment service provider (PSP) is important, particularly one that can offer your customers various payment options. Some providers even come with physical card machines for in-person shopping, so your customers have more ways to pay. These products not only accept all major credit and debit cards but also allow for transactions online, by phone, via virtual terminals, or through links on email invoices. This way, you can easily customise your payment gateway integration for your clients, with a bonus of fraud screening tools.

On your website, make sure you indicate how customers can pay for their purchases in a clean and detailed way. If you can, add logos to make it easier to catch a customer’s eye, so they don’t spend too long looking for their preferred payment option.

Multiple login options

There’s nothing more frustrating for a customer than finally deciding to purchase something, only to be asked to sign up for an account before checking out. Asking users to log in may be convenient for your marketing strategies, but you might lose some potential customers if you don’t allow them to buy products as a guest.

Make sure the option to log in or go for a guest checkout is clear for users; you can lay out both options on one page or menu before the rest of the following process. Encouraging them to create an account on your website can come after the payment process once you’ve established more trust with them. You can also add some benefits or incentives for purchases with an account for them to consider signing up.

Less is more

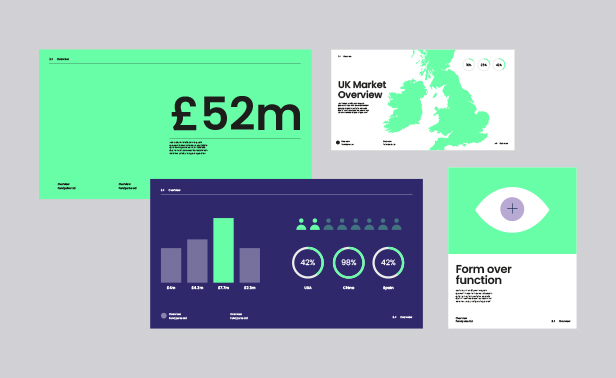

Your web design is crucial for ensuring customers close the deal on a sale and build trust in your business. Half of consumers say that a company’s website contributes significantly to their impression of the overall brand. Poor functionality is a major reason why people leave a site; around 42% say that cluttered layouts, lack of visibility, and poor response time makes them exit a page.

For an optimised payment process, give customers a simple yet visually appealing layout on your checkout page. Avoid using multiple fonts, clashing colours or patterns, and huge blocks of text. Keep it clean, but also in line with your business’s brand and visuals. This can will your website look more cohesive and professional, giving customers a sense of trust and familiarity that will make them willing to return for more.

Point out the errors

Customers want a fast and streamlined checkout experience. If they have to fill out all their information again due to typos or missing fields, they might decide it’s not worth their time. If they press the checkout button with incorrect details, highlight where they might have made an error instead of having them redo the process.

Indicating an incorrect cardholder name, email address, invalid card number, and other mistakes can give users more clarity and ease when rectifying their information. It’ll help ensure that they still go through with the transaction as they use your intuitive, easy-to-use payment page.